Market Overview

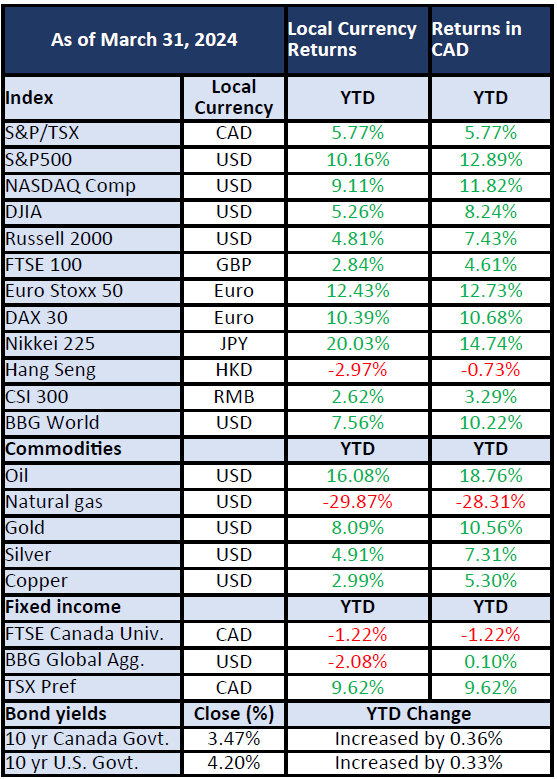

The first few months of 2024 proved to be generally positive, capitalizing on the momentum seen in the final months of 2023 and broader participation among non-technology stocks. This continued optimism helped stock markets trend positive despite investors predicting less interest rate decreases in 2024 than initially thought and the risks of an extended conflict in Europe and the Middle East.

In this quarterly review we will be discussing several key developments, what that means for investment decisions moving forward, and what actions we are taking to benefit client portfolios.

Key themes include:

- Investor expectations for interest rates became much more aligned with central bankers. In our 2023 year-end review we discussed the overly optimistic view investors held around potential rate declines and the risk this posed.

- Entering the year predicting six declines, the market now expects two to three.

- Uncertainty around interest rates will drive volatility throughout the year but fewer rate declines could also indicate a healthier economy than previously thought which should support further growth.

- The Magnificent 7 is no more. Now nicknamed the “Gang of Four” (Nvidia, Microsoft, Meta, Amazon) after Tesla, Apple, and Google were deemed no longer worthy, proving once again that catchy headlines are more marketing than anything else.

- Value stocks (i.e., shares in companies that are trading at a price less than their intrinsic value) closed some of the gap with growth stocks (i.e., shares in companies that are expected to grow their earnings more than the historical average).

- This broader participation in the recent market rally helped to further boost optimism among investors.

- The U.S. economy continues to surprise while Canada has been much weaker.

Market Returns

Why Boring is Exciting

We have spoken much about the gap between “growth” and “value” stocks in recent market reports. With the exceedingly expensive valuations being seen among several large technology companies, the discussion between growth and value warrants further attention.

Value stocks are largely keeping up with growth so far in 2024, and even outperformed in March, but we ultimately feel there may be more outperformance to come from this group. More specifically, quality companies, often described as having strong management teams, a dominant market position, high profit margins, and high free-cash-flow, offer a significant opportunity for both income and capital appreciation.

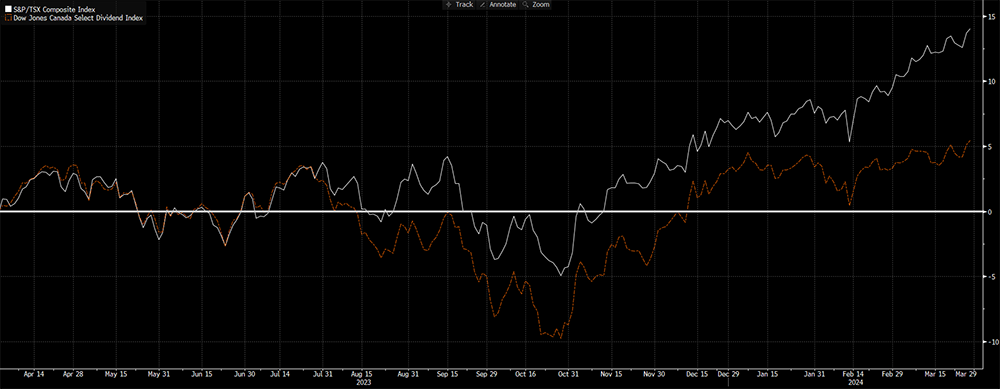

In the past year, the TSX is +14% while the Dow Jones Canada Select Dividend Index (a proxy for Canadian dividend investing) is +5%.

S&P/TSX vs DJ Canada Select Dividend Index

In the past 30 years there have only been five times this index lagged the TSX by more than 10% on a trailing one-year basis. Interestingly, most of the previous occurrences coincided with brief periods when a non-bank stock became the largest weight in the TSX. This makes this instance of underperformance unique in that the biggest stocks in the TSX remain dividend payers. In fact, the bank stocks have done reasonably well of late, but it is the other dividend companies which have lagged considerably. Two sectors full of dividends include communication services (telcos) and utilities, both down 24% and 15% respectively over the prior 12 months.

The current valuations in the overall dividend space are approximately 10.5 times forward earnings estimates while the broader TSX is closer to 15 times. That is a historically wide difference (aka dividends are cheap).

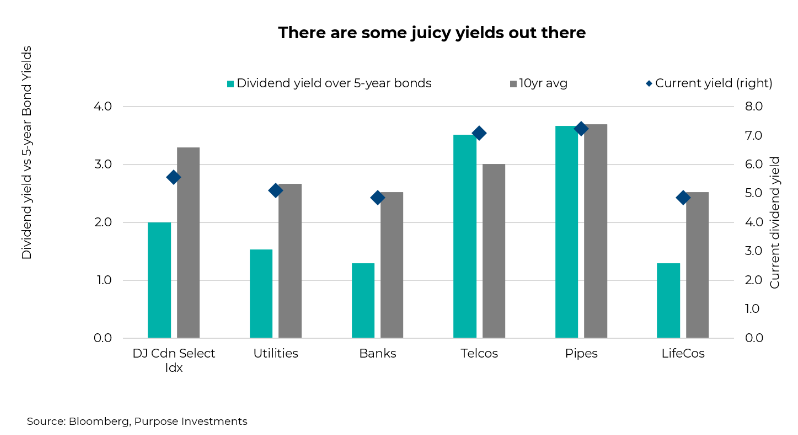

We know dividend stocks don’t perform in a vacuum and the main reason we see for this underperformance is their relative income yields compared to bonds. Bond yields have moved higher, and, with their greater certainty, investors have made the reactive switch to bonds to take advantage of this income and perceived stability.

Despite this, the declining stock prices of many dividend companies have pushed income yields to even more attractive levels. The below chart highlights how various TSX sectors compare to the yield on Canadian 5-year bonds. Coupled with the tax-preferential treatment of Canadian dividends, means the after-tax yield is often far greater than those of bonds.

Investing in fundamentals has never been loud or exciting, but it has provided consistent returns over long periods of time and often with much less risk. Our focus is on anticipating future trends, and currently, that points towards a value-oriented approach. It may not be the most exciting space relative to Electric Vehicles and Artificial Intelligence but from where we sit, we find boring much more exciting for longer-term returns.

A Cautionary Tale on Growth

We have not been alone in saying the large U.S. technology stocks like those in the Magnificent 7 are expensive but the risk inherent in these names can’t always be appreciated until it’s too late. While some of these seven companies continue to push new highs, there are those which have seen a more challenging outlook, often leading to a violent decline in price. We view these situations as a cautionary tale of what can happen when a stock is “priced for perfect”. Meaning the stock price reflects the best (or perfect) scenario for future growth.

Tesla is a company that is no stranger to rapid changes in price, but the recent outlook has challenged even the biggest believers in electric vehicles (EVs). Last summer, dealers began warning of unsold EVs clogging their lots. Ford, General Motors, Volkswagen, and others shifted from frenetic spending on EVs to delaying or downsizing some projects. Some auto executives acknowledge they got ahead of the market with overzealous demand projections. Pandemic-era supply-chain shocks and a resulting car shortage created long waiting lists and early buzz for EVs, making the industry overly optimistic. In fact, Ford cited a $4.7 billion loss on its battery-powered car business in 2023 and project an even greater loss this year. Executives are still confident that EVs will eventually take off, albeit at a slower pace than initially envisioned.

As EV demand has dried up, companies like Tesla, which can’t pivot back to other business models, have taken the brunt of this pressure. Since last year, Tesla have slashed prices by more than 20% on some car models and the stock is down 30% at the time of writing.

Why write about EVs and Tesla? Tesla’s stock was one of the crown jewels of the S&P 500 in 2023. Industry EV sales grew 47% (vs 2.7% in Q1 2024) and investors believed this growth would continue indefinitely as more drivers ditched gas-powered models. We saw in real time what happens when investors become overly enthusiastic over unattainable or unrealistic growth expectations. We are not saying there isn’t a place for the EV industry, and we do think it will continue to experience growth but ultimately, as investors, price matters. There are many instances where investors simply paid too much for a business and suffered for it regardless of how good the underlying business was. We look at this as a good example of what happens when people’s fear of missing out override’s reality. This can be true for investors just as it is among CEOs and offers a warning for the other high-flyers out there.

What we are doing and why

Stocks

Investors shook off concerns over less interest rate declines in 2024 than expected when we began the year and continued to push higher. The broader participation among companies was welcome news although the U.S. has remained the driver of outperformance. That said, many of the global performance leaders now appear overbought, raising the risk of a near-term price correction. Despite this, the base case for further gains in the economy and corporate earnings suggest that corrective action is likely to be relatively short-lived or shallow, providing an opportunity for active investors.

Key takeaways from the first three months of 2024 include:

- The U.S. has continued to be the driver of the momentum we saw in 2023, growing earnings 8%…much better than anyone could have predicted six months ago. Canada was decidedly weaker, reporting earnings down 9%.

- Abroad, Europe was mostly positive, driven by the UK and Germany while emerging markets like China and India lagged.

- Notably, Japan closed at a new all-time high – 34 years since the last high. In fact, the Nikkei has been the world’s best-performing major index in 2024.

- While a likely source of volatility, fewer interest rate declines in 2024 should offer opportunity.

- Investors should prefer a stronger economy with less cuts over a weaker economy that comes with more cuts. A strong economy should provide a lift for more cyclical and value-oriented stocks and sectors such as industrials, energy, and financials.

- Commodities rallied nicely after mixed results in 2023.

- Energy rebounded after a poor end to last year benefiting from a 15% surge in the price for oil.

- Gold made headlines for reaching an all-time high which many note as surprising.

- Gold prices tend to move opposite to bond yields (which have been rising), and amidst net outflows among popular gold bullion ETFs.

- The prime driver of this surge has been buying activity from central banks like China and some countries push away from the U.S. dollar.

The TriDelta equity funds continue to be very different than the broad passively managed stock markets. To begin the year, the TriDelta Growth and Pension Funds have returned 7.34% and 4.75%, respectively. The funds have returned 19.80% and 9.11% over the prior 12 months.

For an overview of how the funds stand today and our top holdings please visit our website for more information.

Learn more about our strategies:

TriDelta Pension Equity Fund

TriDelta Growth Equity Fund

Bonds & Interest Rates

Bond indices were down slightly over the first three months of the year, giving back some of their Q4 gains. This can be attributed to the revised expectations for interest rate declines in the latter half of 2024. Investors have begrudgingly aligned their expectations for interest rates with central bankers and now predict three 0.25% cuts beginning in the summer. Central banks have largely had to walk back their talk on inflation progress into more neutral territory and are taking a wait-and-see approach to changes. Notably, many central banks are likely to take their cues from the U.S. which is in a politically sensitive position given the U.S. election. The U.S. Fed does not want to be seen as influencing the election so unless something breaks, rate declines in the U.S. will be window dressing rather than a significant shift in policy.

- Canadian economic data has been mildly positive with our most recent GDP report coming in at the highest it’s been since January 2023. Unemployment has been rising but still below our long-term average. The U.S. economy has had an undeniable strong run of economic data.

- Price pressures in consumer services as well as elevated oil prices will make meaningful declines in inflation difficult to achieve in the near term. However, we do expect inflation to resume its gradual decline towards the end of 2024.

- The Bank of Canada has impressed with its adherence to the inflation fighting mandate, but it is not clear that they are willing to go it alone on rate cuts without the U.S. Fed.

- Market volatility has been surprisingly muted despite changes in interest rate expectations.

- Corporate Investment Grade and High Yield bonds are the most expensive they have been in the past two years. As the interest rate environment develops there should be further opportunities for a more attractive entry point.

- The primary risk for sovereign bonds now seems to be even greater U.S. fiscal spending (it is an election year, after all) or a European parliament that becomes more focused on pressing issues such as the war(s), decarbonization, or energy independence.

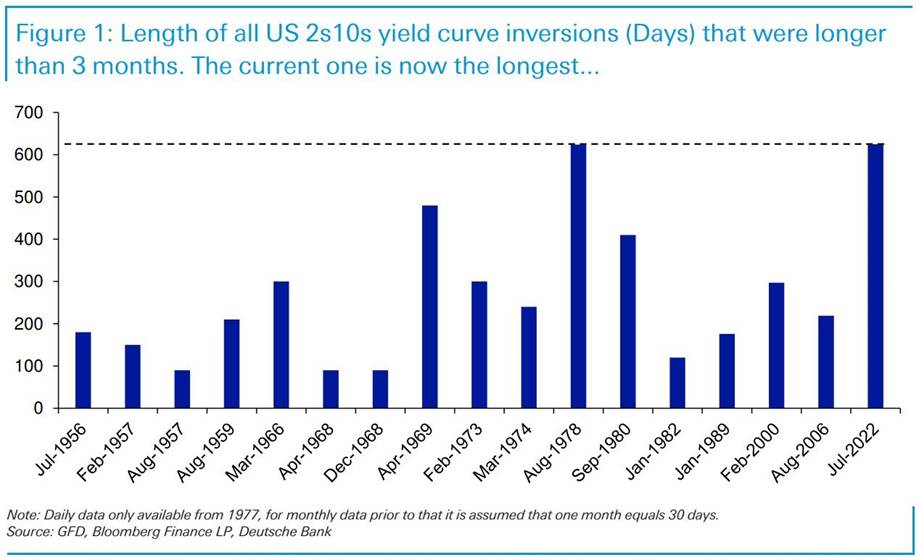

- March marked the longest period in history for an inverted yield curve without a recession.

All the guesses and market odds around interest rates were largely wrong – and will probably continue to be. That doesn’t change the fact that these expectations have great power and have the ability to move the market. Although this is expected to continue to drive market volatility, it will undoubtedly create opportunities in both bonds and equities.

Preferred Shares

Canadian preferred shares have appreciated nearly 20% over the prior 6 months. There has been very little interest in issuing new preferred shares which has put a cap on supply as others are also redeemed. Preferred shares have further benefited from the relative value appetite among investors when comparing yields to corporate bonds and equities.

Alternatives

Alternative investments – those not publicly traded – have continued to provide steady income and diversification benefits for investment portfolios.

Key updates for our portfolios include:

- Canadian multi-residential real estate has been supported by surging population growth and the rental market will continue to present investors with considerable opportunities.

- Although there have been positives in new builds, Canada will have a continued lack of supply to support housing affordability.

- Real estate strategies with an exposure to purpose-built student housing have faced questions over the cap on international students. While something our managers are monitoring, the cap will directly impact colleges which we have no exposure to.

- Trillion-dollar asset manager, Blackstone, has called a bottom for U.S. real estate. Blackstone, among others, have acquired several public and private REIT portfolios.

- Private real estate transactions largely stalled in 2023 but the prospect of falling interest rates and greater certainty in bond yields bode well for activity to pick up and real estate managers to complete planned exits.

- Private credit funds continue to fill an essential void in traditional bank lending. Elevated interest rates have been felt by consumers and businesses alike at a time where access to financing has been most needed.

- This has provided an expanded pool of opportunities which should support future returns.

Canadian Wealth Wisdom – A TriDelta Podcast

TriDelta Private Wealth has a podcast.

You can now listen to our library of podcast recordings which tackle varying financial planning and investment related topics as well as an opportunity to better get to know your TriDelta team. We will continue to add new recordings moving forward so bear with us as we build out our library of resources you may find interesting and helpful.

A good place to begin is our recording with Ted Rechtshaffen and Kyle Taylor to discuss the founding of TriDelta Private Wealth and how we have evolved since 2005 titled “Why TriDelta”.

TriDelta Private Wealth – Canadian Wealth Wisdom – TriDelta Private Wealth

Looking Forward

There is always a constant struggle between optimism and pessimism. As investors, we all know it well. Driving these emotional swings are market fundamentals, economic indicators, and geopolitical events, just to name a few. It’s an essential aspect of price discovery but drives volatility and creates opportunities for investors. We expect there to continue to be volatility throughout the year for a variety of reasons but remain committed to see through the noise and take advantage when we see opportunity and manage risk when prudent.