As my clients age, one of the key financial planning questions they ask is, “Can I afford to live in a retirement residence?” and the follow-up, “How much extra in expenses do I need to plan for?”

Usually the answer to the first question is yes, and the answer to the second one is not nearly as much as you might think. Often our clients will look at a nice, private retirement residence and see a $6,000 per month cost and get sticker shock. They wonder how they can suddenly add $72,000 to their annual expenses.

There are five important factors that make the monthly expense much easier to handle.

1. If you move out of your home, you are leaving behind meaningful expenses. First off you will eliminate most of your food costs and utilities. If you are renting, you will eliminate your rent. If you are an owner, you will eliminate your condo fees and/or maintenance costs, as well as realty tax. It is impossible to provide a general savings number given the range in lifestyles and realty costs across the country, but it would be fair to say that most people will eliminate anywhere from $18,000 to $60,000 a year by not living at home.

2. When you are at the stage of living in a retirement residence or nursing home, your lifestyle expenses usually decline meaningfully. Your travel costs, dining expenses, new clothing budget and your entertainment spending — which could have been $25,000 or more when you were 70 — might now be $2,500 or even $0 when you are 88.

2. When you are at the stage of living in a retirement residence or nursing home, your lifestyle expenses usually decline meaningfully. Your travel costs, dining expenses, new clothing budget and your entertainment spending — which could have been $25,000 or more when you were 70 — might now be $2,500 or even $0 when you are 88.

3. There are tax credits that can meaningfully help. In particular, the Medical Expenses and Disability Tax Credit are two of the largest among several that can reduce after-tax expenses. For example, if there are health care costs in a retirement residence or the entire cost of a nursing home, these can be considered medical expenses and a large percentage of those expenses can be deducted from income. To keep it simple, this means that many seniors could get back maybe 25 per cent to 30 per cent of their health-related expenses if they are sizable.

4. When funding senior living, many seniors don’t take into consideration all of their sources of income, which could include Canada Pension Plan, Old Age Security, RRSP/RIFs, TFSAs and non-registered investment income, pension plans (personal or from spouse), family recreation property, etc. It is important to remember that these funds have been built over a lifetime so that they could be used to cover retirement expenses. Now is the time.

5. In some cases, people have bought long-term care Insurance that will cover some health care costs.

This entire topic is often not discussed, so even getting the questions out in the open is a great start. Unfortunately many families find the topic too difficult to broach, and as a result, informed decisions sometimes never get made.

When trying to answer the question of where to live for your personal situation, some of the key issues to include would be:

- Your health status and the level of support required

- The annual expenses of living at home today

- Your preference in terms of residence

- The question of private versus public

- Whether your family is close by and can be relied on for support

- Where you want to be (i.e. your current neighbourhood or closer to your children)

- A financial assessment of the real options and how much income could be created from the sale of a home

Let’s start with costs.

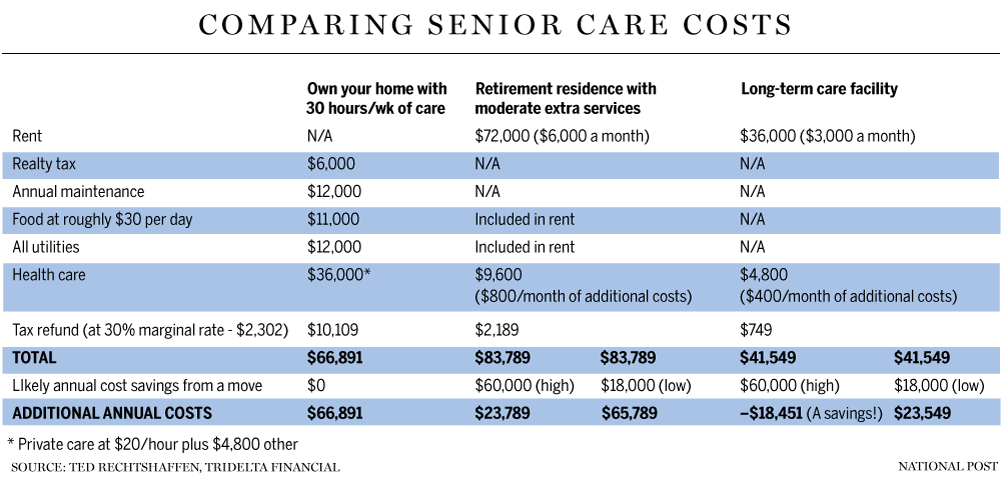

While a general overview, the accompanying chart tries to compare three scenarios: living at home with 30 hours a week of private care; living at a private retirement residence; and living in a public nursing home.

While prices range across the country, the basics for a public nursing home can range from $0 to roughly $3,000 a month.

A private retirement residence can range from $3,000 to roughly $7,000 a month for basic care. These numbers can easily climb another $1,000 to $3,000 a month as extra care is required.

Living at home with part-time private care of 30 hours a week can cost $31,200 a year at $20 an hour. This is a large enough number, but as health deteriorates, the amount of care required increases substantially. If this becomes full time 24/7 care at $20 an hour, the number becomes $175,200! Not only is this a huge cost, but someone now needs to manage the three to five people required to work as full-time caregivers.

These numbers can certainly look pretty frightening, but remember as I mentioned at the top of the article, it isn’t as bad as it looks. The health care costs of Canadians in their latter years will very likely rise, but in many cases those extra costs will not only be largely covered by expense reductions, but for homeowners who sell their property as part of the transition, the income generated from the sale of the home can often more than cover off any additional living expenses.

As an example, someone sells a home for $1 million and moves into a retirement residence. The $1 million is invested and in total returns a fairly conservative five per cent a year. That translates into $50,000 in growth a year. Even if this is $40,000 a year after tax, in many cases your annual expenses will grow less than $40,000 a year if moving to a retirement residence.

There are also many provincial health programs that provide some personal care services to those in need regardless of where they are living. These support services are usually provided at no cost but do have a limit in terms of the amount of service provided.

While declining health can bring many challenges, the impact to your finances doesn’t have to be too bad … or not nearly as bad as you thought.

Reproduced from the National Post newspaper article 13th March 2019.