Market Overview

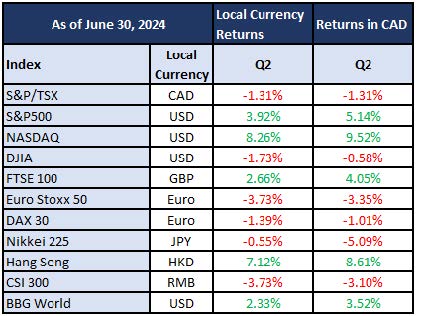

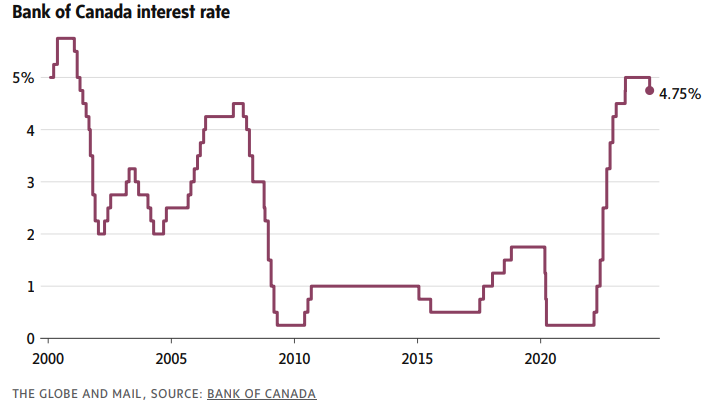

The second quarter of 2024 brought with it the highly anticipated first move lower for interest rates in Canada and Europe. The move won’t do much, by itself, to reduce monthly payments on mortgages, car loans or lines of credit, but it kickstarts a shift in monetary policy that should see interest rates fall further. The U.S. has been a different story as rates remain elevated but there are signs the U.S. consumer is slowing which may bring about a cut in September. Despite the news around interest rates, most non-U.S. markets were negative for the quarter as U.S. resilience continues to be the norm.

In this quarterly review we will be discussing several key developments, what that means for investment decisions moving forward, and what actions we are taking to benefit client portfolios.

Key themes include:

- Market gains continue to be driven by the few rather than more broadly and the divergence among some markets continues to be a real challenge.

- Canada’s TSX is up about 4%, which isn’t bad but certainly not as good as many others. Europe is up about 8%, Asia is too, and the U.S. S&P 500 is ahead by just under 20% [all returns in CAD]. The U.S. has become more challenging due to its narrow leadership, as five companies contributed over half of the market’s gains.

- Concentration in the U.S. has changed the perspective many investors are taking when looking at the S&P 500.

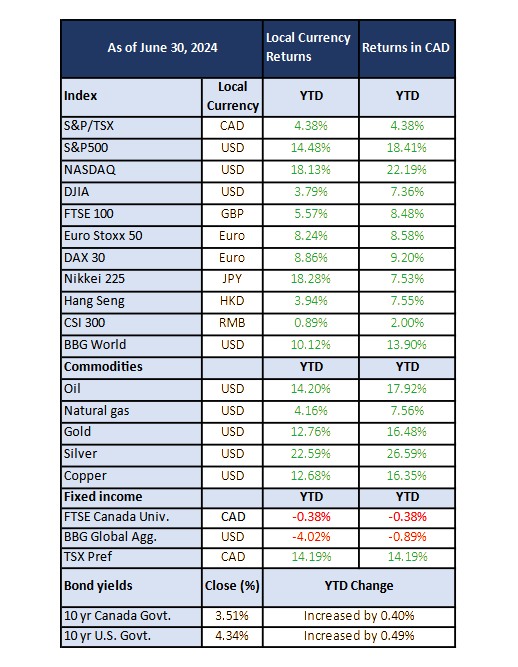

- Today, the largest 10 companies make up 35% of the total index. This is the highest it has ever been and has many doubting the index as a reasonable benchmark for equity portfolios given the inherent risk involved with the reduced diversification.

- Tech stocks continue to grind higher as anything related to Artificial Intelligence has stretched even the most enthusiastic estimates for growth.

- Generally, growth stocks continue to dominate. The Russell 1000 Growth Index and Value Index have returned 20.26% and 5.46% respectively. The S&P Dividend Aristocrat Index, a proxy for dividend stocks, has returned just 0.29% in the same period.

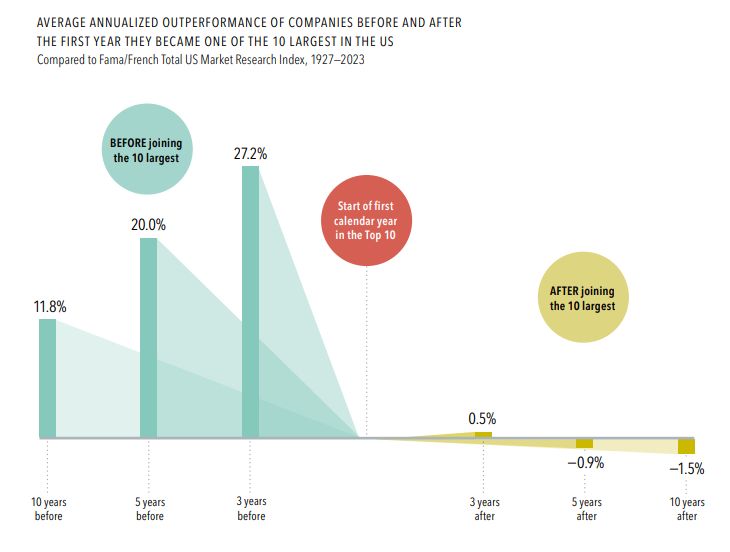

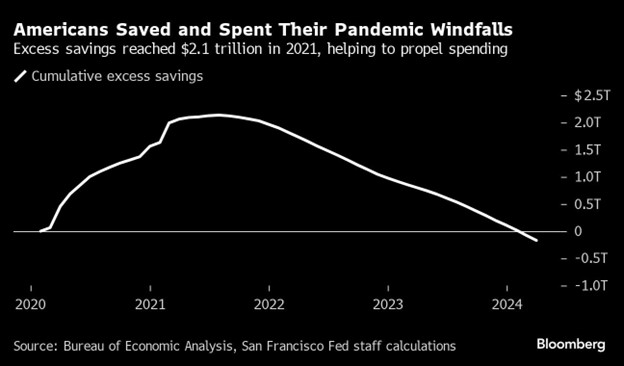

- The U.S. economy has had an undeniable strong run of economic data, but the consumer is also showing signs of slowing. The resilience of American consumers has been a pillar of the unwavering strength of the U.S. economy in recent years.

- Political risk and policy uncertainty have continued to be a cause for concern among investors and this is likely to contribute to greater volatility through the back half of the year.

Nvidia and Market Concentration

It is an election year in America, so we have been hearing lots of scary stories in the news as pessimism tends to be in vogue with politicians jostling to make themselves stand out. That said, there is one area in which American supremacy has been unquestionable: stock markets. U.S. stock market performance has been the undisputed champion in 2024 and Nvidia has arguably seen the most media attention of the tech darlings driving this performance.

Who is Nvidia? Nvidia has been crowned king of the Artificial Intelligence (AI) frenzy sweeping the globe and can boast 125% sales growth and $61 billion in revenues over the past year to prove it. In more technical terms, they design and manufacture the microchips which are being used to facilitate the shift towards AI enabled tech.

Why write about Nvidia now? Nvidia has been the most notable beneficiary of AI. The company took 25 years to hit the coveted $1 trillion valuation, nine months to hit $2 trillion and a little more than three months to hit $3 trillion. They also very briefly took the top spot as the largest company in the world before it was reclaimed by Microsoft.

This isn’t all new. 25 years ago, Cisco, which sold the routers every company needed to get online, was the Nvidia of the 1990s internet boom. Its stock price chart in the late ’90s looks very similar to Nvidia’s today. From 1998 to 2000, Cisco quintupled in price — and then, from 2000 to 2002, it collapsed, when a hardware glut arrived just as a market downturn dampened demand. Cisco is a prime example of people who made an investment in a great company at a terrible price. In fact, if you bought Cisco at their peak in 2000, you are still in the red over 20 years later.

Going back to 1926, there have been only 12 companies to claim that top spot: AT&T, Cisco, Dupont, Exxon Mobil, GE, GM, IBM, Microsoft, Philip Morris, Walmart, Apple, and now Nvidia. History isn’t always on your side when you go through the list. Pick any one and you can remember how someone else caught up to the leader and eventually eroded their market share. Nvidia makes up a large chunk of the market share today but it’s not a matter of if others catch up, it’s a matter of when and at today’s prices investors are effectively predicting they continue this dominance forever. We have spoken much about the gap between “growth” and “value” stocks in recent market reports. With the exceedingly expensive valuations being seen among several large technology companies, the discussion between growth and value warrants further attention.

While we for one are wary of stocks “priced to perfect”, it carries implications for the markets we can’t ignore. The sizable outperformance of Nvidia and others has led to an increasingly concentrated S&P 500. A few interesting facts include:

- Nvidia, Apple, and Microsoft account for more than 20% of the total index, the first time three companies have been that influential since 2000, as per Dow Jones Market Data.

- The top 10 companies represent 35%, the highest it’s ever been.

- The top five companies account for more than half of the S&P 500’s gains to the end of June.

The influence this has on markets and investor psychology is a real challenge. On June 24th more than 70% of the S&P 500 companies posted positive returns on the day but the headline return for the index was negative in large part due to a 7% decline for Nvidia. A week later we saw the opposite when 382 companies closed in the red but the influential M7 names were all positive which played a sizable role in why the index was positive that day.

Ideally, markets make new highs with broad participation in moving the overall index higher. This isn’t happening.

What does this mean for investors? It means the S&P 500 is becoming a less and less relevant comparison for many portfolios. Far more important is paying attention to the investment risk you are prepared to stomach and ensuring you have a well-diversified and actively managed portfolio that can take advantage of the ups and downs of the markets without exposing you to undue risk.

Mid-Year Outlook

We began 2024 with an outlook for what was to come, and this review serves as a good point to assess those expectations and how our outlook for the latter half of the year and beyond may have shifted.

- Concerns of a serious recession continue to fade. Consumer spending has slowed both in Canada and abroad, but household debt has remained largely in check.

- The 2020s have seen a dramatic move higher in correlations between stocks and bonds.

- This higher correlation calls into question the defensive attributes of bonds in investor portfolios. The silver lining is that, with higher yields, bonds now offer a more attractive return.

- The U.S. consumer has been a pillar of the U.S. economy in recent years and have allowed the U.S. Fed to keep interest rates higher for longer.

- While the alarm has not sounded, there is evidence that Americans have spent their pandemic savings and may not offer the same level of support moving forward.

- Political risk is likely to cause periods of higher volatility and uncertainty for the remainder of the year. 2024 has been the year of the vote and November will bring with it a highly contentious U.S. election which carries implications globally.

- Even if you can guess right on who wins which election, how the market reacts is another variable that often makes correct guesses end up being disappointing from an investment perspective.

- The first half of 2024 has generally been positive for global equity markets but not all have benefited the same.

- There was a 35% difference between the top performing markets (U.S., India, and Taiwan) and the bottom performing markets like Brazil and Latin America.

- Stocks are likely to continue to grind higher but the usefulness of the S&P 500 for comparison purposes is being eroded as concentration becomes more prevalent.

- The S&P 500 Equal Weight Index has proved a better visual for how the U.S. is performing without the outsized impact of the large tech companies.

- Markets proved overly enthusiastic about interest rate declines into the first half of the year but now are more grounded.

- Presently, the general market consensus expects four 0.25% cuts to interest rates over the next 12 months in Canada and for the U.S. Fed to begin cutting in September.

What we are doing and why

Stocks

The second quarter finished negative for most non-U.S. markets as the narrow leadership of the large U.S. tech companies resumed their dominance. It was an easy excuse to blame the poor Canadian markets for the outsized selling pressure due to the change in tax laws; however, Canada was not alone. Many markets began to weaken as the U.S. continued to make new highs.

Key takeaways from the first half of 2024 include:

- Diverging economic activity is likely to continue to drive diverging market performance with some markets giving up some of their earlier gains.

- The diverging performance across sectors and global markets has provided an opportunity for active managers and we expect this to continue.

- A noticeable weaking in the U.S. economy would have dramatic implications for markets. Bringing the U.S. Fed in closer alignment with global peers could signal another era of easier monetary policy which would be very good for stocks.

- In June, equity yields relative to bond yields dropped to the lowest level since the Dot Com Bust. The underperformance of dividend stocks can at least partially be explained by this phenomenon and a shift in interest rates may be enough to spur investors to act.

- Gold has been a notable beneficiary of the increased geopolitical uncertainty along with the increased demand for the metal from China, and rising government deficits.

The TriDelta equity funds continue to be very different than the highly concentrated passively managed stock markets. To begin the year, the TriDelta Growth and Pension Funds have returned 9.74% and 4.99%, respectively. The funds have returned 20.90% and 11.28% over the prior 12 months.

For an overview of how the funds stand today and our top holdings please visit our website for more information.

Learn more about our strategies:

TriDelta Pension Equity Fund

TriDelta Growth Equity Fund

Bonds

Bond markets in Canada are down slightly for the year, having given back some of the gains experienced at the close of 2023. Presently, we view bonds as fairly valued and supported by a, generally, healthy market for bonds.

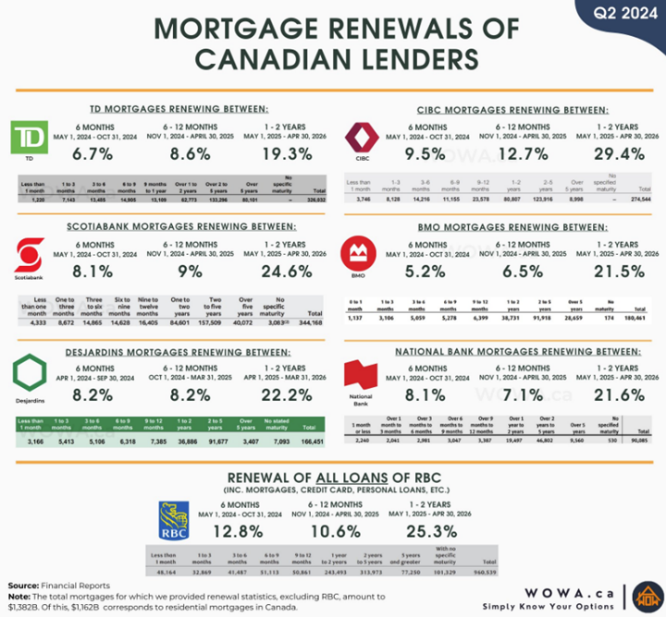

The Bank of Canada decreased interest rates for the first time in June and are expected to reduce rates again in the Fall with the possibility of two additional cuts in the first half of 2025. This comes at a time when an increasing number of Canadians are due for their first post-COVID mortgage renewal.

Investors are hopeful September will be the first interest rate cut in the U.S. and the Fed looks to be signaling this will be the only rate cut in 2024. This is in stark contrast to the beginning of the year when the market expected six interest rate cuts. The average mortgage rate for homeowners in the U.S. is still 3.8% which has contributed to the resilience of U.S. consumers.

- The Canadian dollar was largely unchanged against the U.S. dollar, Euro and Pound.

- This is a positive for the Bank of Canada as they can continue cutting rates without worries of a quickly weakening currency driving import inflation.

- Canadian markets seemed to have settled on 3.5% as the new long run neutral policy rate (4.5% for U.S.).

- We are likely to have more guidance from the U.S. Fed in August which may note a clearer shift.

- Going back to 1968, the U.S. Fed, on average, began to cut interest rates 8 months after the last hike. We are now over 12 months since the last hike.

One challenge facing bond investors today is the rising correlation with stocks. There have been similar periods in the past which have favoured active management in this respect. We continue to lean more towards bonds with shorter terms for yield and safety but are exploring opportunities within our strategies as the cycle for interest rates evolve.

Preferred Shares

Canadian preferred shares continued a strong showing for the year and are up 14% to the end of June. We have previously discussed the shrinking universe for preferred shares as a positive for patient investors. To date, there have been 14 redemptions of preferred shares equating to $4.7 billion. Already triple last year’s redemptions.

Alternatives

Alternative investments – those not publicly traded – have provided mixed returns for investors but there is evidence the new cycle for interest rates may represent a turning point for greater returns.

Key updates for our portfolios include:

- Canadian private real estate investments have continued to provide positive returns.

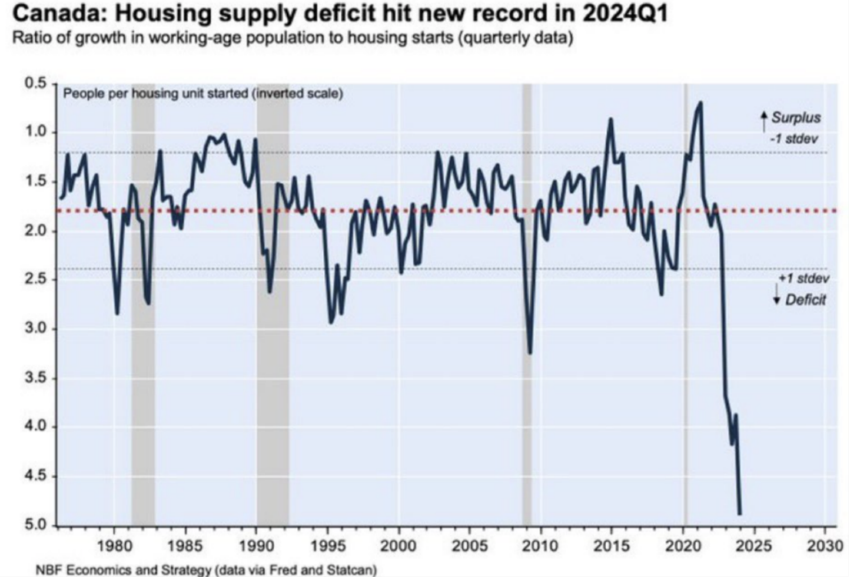

- General market activity remains limited given where interest rates stand but demand for rentals persists. At the current pace, Canada is still adding over one million new people each year, driving housing supply to new lows.

- Canadian real estate may be in the midst of a new cycle brought on by the forecasted declines in interest rates. Several managers have cited this as a catalyst for rising values and prices which should be accretive for investors.

- Private credit funds continue to fill an essential void in traditional bank lending. Elevated interest rates have been felt by consumers and businesses alike at a time where access to financing has been most needed.

- This has provided an expanded pool of opportunities which should support future returns.

- Limited liquidity among private credit funds has been a challenge but should allow managers to better capitalize on near term opportunities within their portfolios.

Canadian Wealth Wisdom – A TriDelta Podcast

We have added additional recordings to our growing library of podcasts. This quarter we focused on discussing integrating insurance with your financial plan. Topics include:

- Tax Saving Strategies for Your Corporation

- What is Critical Illness Insurance?

- Navigating Insurance Throughout Your Life

Looking Forward

Earlier this year we spoke of the constant struggle between optimism and pessimism among investors. We continue to believe this will be key consideration for the remainder of the year but are actively looking to take advantage of the opportunities this may provide. We emphasize the need to stay grounded in fundamentals rather than becoming starstruck by popular stocks of the day. This is often a primary method of managing risk and we feel is prudent given the concentration of the S&P 500 and other global indices heavy reliance on U.S. stocks.

Ultimately, being patient is a key part of success in volatile markets.