Market Overview

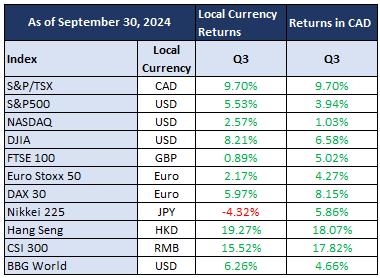

September ended on a bang with even lagging Chinese stocks beginning to participate in what has been a very good year for the markets. In fact, it was the best first nine months of performance for the U.S. S&P 500 since 1997. Even so, the third quarter certainly wasn’t smooth. Early August saw the largest single day decline in over two years and contributed to the S&P 500 and Nasdaq being down over 10% from their mid-July record highs. Despite this, investors focused on expectations for a September interest rate decline and moderating inflation as reasons for optimism.

Perhaps the most important takeaway from the prior three months was the broader participation propelling markets higher. Notable outperforming sectors included real estate, financials, and utilities which helped Canada beat out the U.S. and many global peers over the quarter.

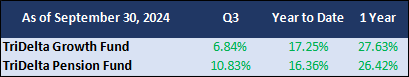

The TriDelta equity strategies continue to be very different than the highly concentrated passively managed stock markets and have demonstrated strong returns.

In this quarterly review we will be discussing several key developments, what they mean for investment decisions moving forward, and what actions we are taking to benefit client portfolios.

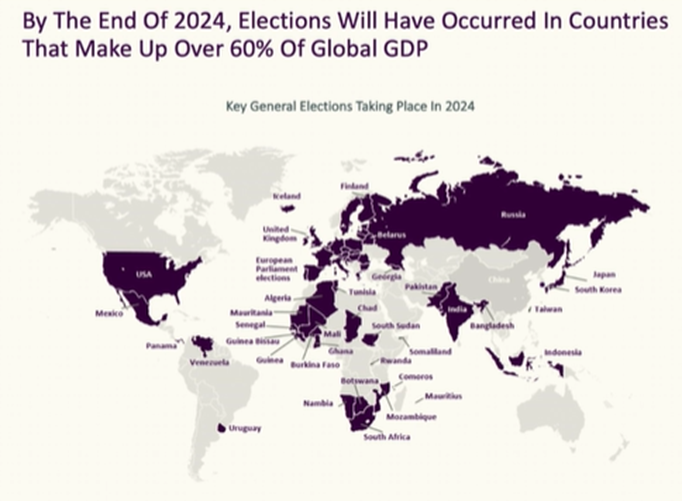

Election Season

It has become clear that Canada will not see a federal election until at least next year but 2024 has undoubtedly been the year of the vote. In fact, countries which account for over 60% of global GDP will have had elections.

Regardless of how the U.S. election develops, it is important to keep in mind that positioning an investment portfolio based on an expected election outcome is rife with uncertainty. Not only is it challenging to correctly guess the victor, but it is even more difficult to gauge the right investment based on that winner.

Let’s remind ourselves of the 2016 election and how these errors can prove costly. Most experts were convinced that Clinton would win but if Trump won then markets would surely collapse. Not only did Donald Trump win the election, but the equity market rallied by close to 30% in the following 12 months. Being out, or worse, being short the equity market at that time would have been an expensive mistake.

While analysts and investors will always speculate how markets will react to an election outcome, there is no “typical” election year return, and we know from experience that there are often more important factors going on that drive markets. There have been a wide range of results from the 2008 bear market to the market rally in 1980. Interestingly, 2024 is shaping up to match or beat 1980’s S&P 500 market performance.

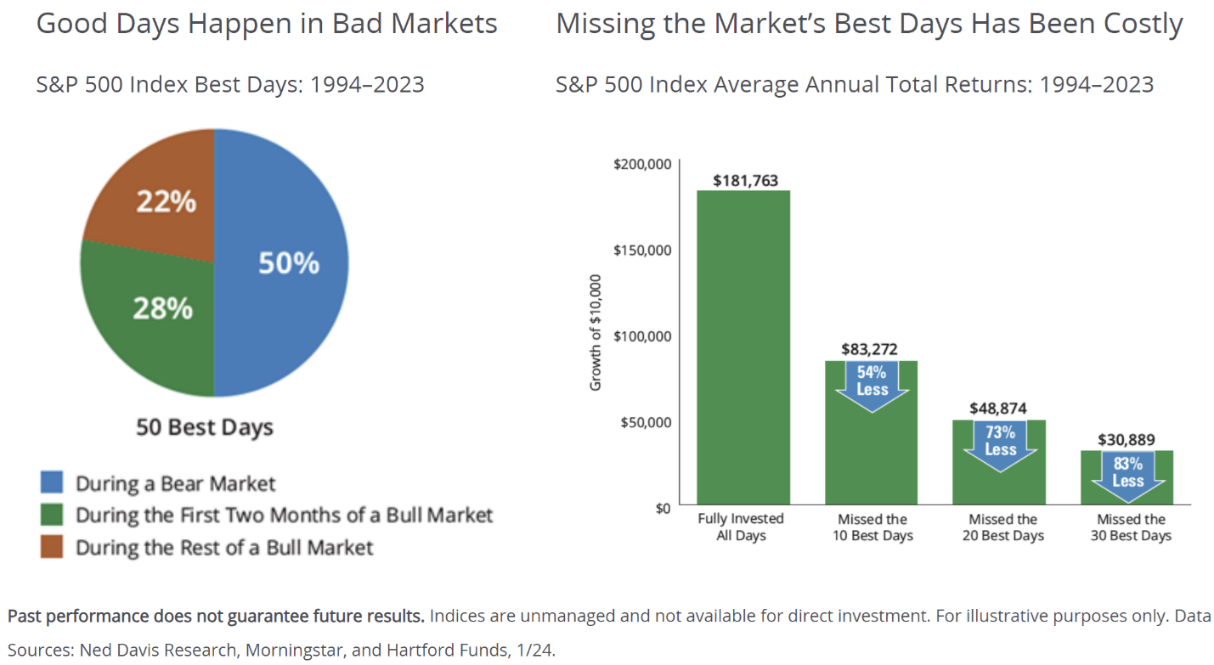

What we do know is the months between July and November historically tend to have greater volatility in an election year before receding immediately thereafter. Active managers willing to take a logical view of the markets and not allow short-term election noise to distract from long-term goals are poised to take advantage of these pockets of uncertainty.

What we are doing and why

Stocks

The third quarter of 2024 saw broad gains for most major global markets which delivered the long-awaited rotation towards a variety of sectors that stood to benefit from falling interest rates.

- The third quarter saw a change in leadership with real estate, financials, and utilities leading the surge. This greatly benefited Canada’s TSX given our heavy weighting towards financials and resource related industries.

- Dividend stocks also benefited from the broader positivity. The S&P Dividend Aristocrats Index returned over 11% during the prior three months.

- Significant volatility in U.S. tech stocks was prevalent early in the quarter with the heavily concentrated S&P and Nasdaq being down 10% and 13% between just July and August.

- Concentrated indices, expensive U.S. valuations, and a largely disappointing earnings season for tech stocks have made the case for investment in other under owned sectors and geographies.

- We have advocated for this shift many times over previous market reviews.

- Public Real Estate (REITs) had a standout quarter being up almost 23% in Canada. Investors shied away from the sector the past two years because of higher interest rates but offer an example of one sector benefiting from the recent fall in rates.

The TriDelta strategies have maintained an emphasis on stocks with discounted valuations, positive earnings, and growth potential. The recent outperformance of our dividend heavy Pension Fund is indicative of the rotation we have seen year to date, and we expect this to offer further opportunities into 2025.

For an overview of how the funds stand today and our top holdings please visit our website for more information.

Learn more about our strategies:

TriDelta Pension Equity Fund

TriDelta Growth Equity Fund

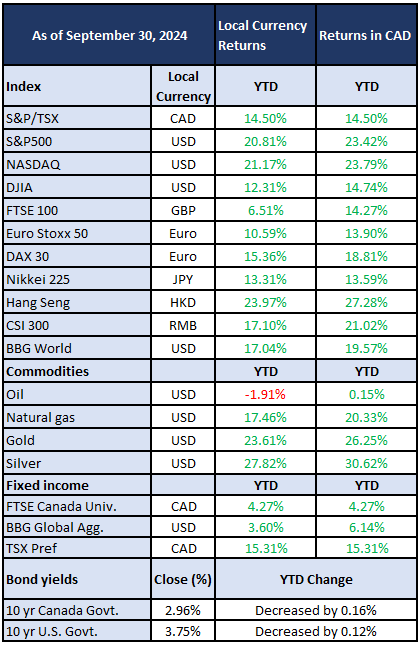

Bonds

Canadian bond markets rose 4.27% to the end of September during a period which often sees little activity during the year. Falling interest rates contributed to a generally positive environment for bonds as investors looked to lock in higher yields given the market expectation for additional rate cuts into 2025.

- Interest rates in the U.S. fell for the first time in over two years which, globally, marked the end of the most rapid and globally synchronized monetary tightening cycle in over 50 years.

- Investors remain optimistic, expecting 1.75% of additional declines into 2025.

- The Bank of Canada has now decreased interest rates three times to 4.25% and signaled there are likely more to come.

- Most see the global movement towards lower interest rates as positive, but investors need to appreciate the shock still being absorbed by consumers and businesses. This will have large implications for Canadians facing mortgage renewals at significantly higher rates.

- The inverted yield curve of the past two years has often been noted in the case investors made for a looming recession. Recent weeks saw the yield curve return to normal (short-term bond yields less than long-term yields).

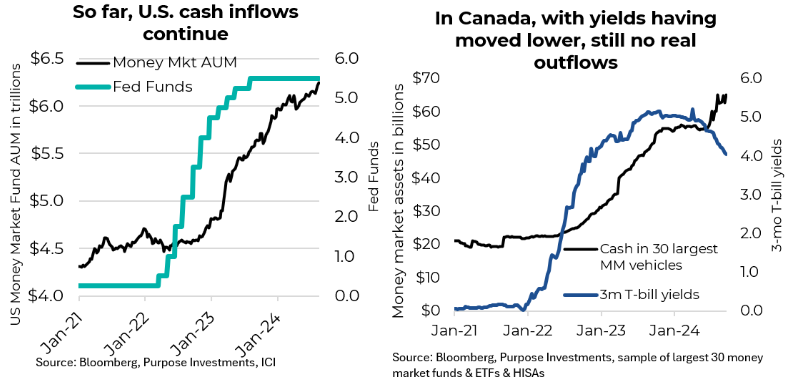

- The bottom line is investors and savers should be rethinking where they’re keeping some of their cash. Notably, we have not yet seen a decline in money market funds despite falling cash yields – but it is certainly coming soon.

-

- Despite falling yields, an interesting investment option can be found today that is paying yields in the 8% to 9% range on investments we believe are only slightly higher risk than GICs and money market funds.

-

-

- TriDelta recently wrote an article featured in the Financial Post about this option: Financial Post/Structured Notes

-

- Bond yields have limited upside barring an unexpected acceleration in labour market indicators. Corporate bond yield spreads are likely to remain at the lower end of their historic range unless tangible signs emerge that the economic recovery is threatened.

The bond market remains healthy and there is growing evidence the U.S. Fed has been successful in achieving the elusive “soft landing” many had been hoping for. However, there is a clear disconnect (especially in the U.S.). With equity markets at all time-highs, tight credit spreads, and recession-like cuts in interest rates being predicted this does not seem logical. Our view continues to be that the expectation for declines in interest rates from central banks are overdone, similarly to how we began 2024.

Despite this, the global economic recovery, while not firing on all cylinders, is expected to stretch into 2025.

Preferred Shares

Canadian preferred shares have continued to have a great year and are up 15.31% to the end of September. 2024 has seen far more redemptions than previous years resulting in patient investors having benefited from the shrinking universe for this investment type. There are still those with 2025 maturities which are likely to be redeemed so that companies can issue new preferred shares at lower rates or even lower yielding bonds. We believe this offers an opportunity for investors given the depressed prices of several available preferred shares likely to be redeemed.

Alternatives

Alternative investments – those not publicly traded – are expected to grow to $28 trillion in 2028 from $15 trillion in 2022. There are several key reasons for this which offer a strong case for inclusion in long-term investor portfolios.

- We have seen government debt explode in recent years which likely means the private sector will be relied upon to fund growth in key asset classes.

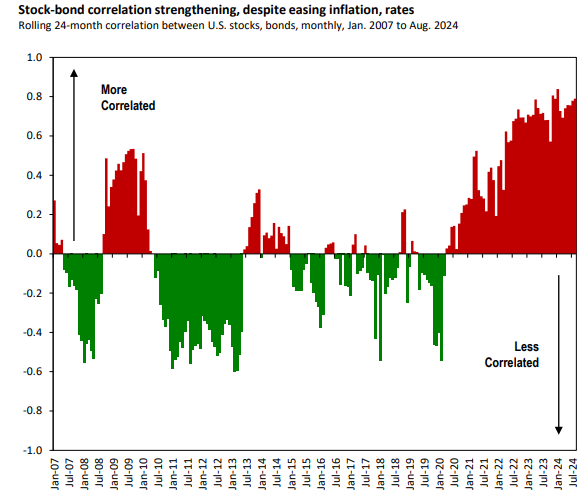

- Alternative investments provide diversification benefits, especially during what many forecast to be a rapid change in traditional portfolio construction.

- The rising correlation among stocks and bonds is a key consideration for building diversified portfolios. This attribute has become even more critical as we transition from a low-growth, low-inflation environment to one of higher GDP and inflation.

Key updates for our portfolios include:

- Our real estate managers continue to generate attractive cash flow and acquire new multi-residential properties while providing resiliency amidst market volatility.

- Falling interest rates should provide support to asset values and increased activity in the space. This should prove beneficial for investors for both investment growth and enhanced liquidity.

- A primary function of Canadian private lending is partnering with the small and medium sized businesses to help support long-term growth and navigate difficult economic periods.

- Rapidly rising interest rates have hurt consumers and businesses alike. As interest rates decline, this should support refinancing and general activity to enhance portfolio liquidity and investment growth.

- One asset class seeing significant private sector support is infrastructure. It is estimated the world will need to invest $3.7 trillion per year towards infrastructure through 2035 to keep pace with expected GDP growth.

- We recently completed due diligence on one such strategy with almost 400 infrastructure assets in over 25 countries.

It is becoming increasingly difficult to diversify portfolios using traditional, public asset classes. Alternative investments offer a means of reducing volatility, enhancing cash flow, and co-investing with large institutional investors.

Commodities

Most commodities have continued to see gains throughout the year and Q3 proved no different.

Much attention has been paid to Gold this year, but Silver quietly reached its highest level since December 2012 and has outperformed its yellow cousin to the end of September.

- Investors largely attribute the precious metal rally to their importance for industrial production, central bank buying, and safe-haven demand.

- Geopolitical and economic uncertainty have increased in the post-COVID era amid heavy debt loads seen across the globe, as well as wars and sanctions that have made many nations wary of the U.S. dollar.

- According to Bank of America, gold surpassed the Euro to become the second-largest reserve asset after the U.S. dollar and now represents 16% of global bank reserves – the U.S. dollar represents 58%, down from 70% in 2002.

China’s central bank has been a notable buyer of gold this year, but the country’s influence on commodities more broadly is also important. As the world’s second largest economy, China’s struggles over the past two years have had a direct impact on the demand for these metals, oil, and gas.

- China’s recently announced stimulus package led to a surge in base metals like iron, copper, and nickel on renewed optimism toward increased demand in China. This is good news for Canada, given the 12.8% weight of the Materials sector in the S&P/TSX Composite.

- Interestingly, oil did not benefit and, instead, has seen three straight months of declines. Conflict in the Middle East has provided some support for oil prices, but investors are increasingly concerned about the near-term demand if China does not see recovery and if Saudi Arabia increases oil production.

Getting a Jump on the Year Ahead

A new school year has begun and whether you have kids in school or not, September can often act as a good reset for the months and year ahead. Perhaps life has changed, or your goals have shifted, but regardless the Fall can be a great to time to reassess your financial picture. Whether it’s creating a new financial plan or reviewing an existing one – this is one of the ways that we can help.

Another way we can help is through our National Bank connection on mortgages and lines of credit. For clients, we can get great rates for you and, in many cases, immediate family members.

Looking Ahead

Despite the strong returns experienced by investors in 2024, there remain real concerns people have but we often see disagreement over what constitutes a market correction and what can be defined as a true crash.

Market corrections happen because of a change in ‘leadership’. They are a healthy reality of economic cycles and although they can lead to near-term pain, they also offer significant opportunities. Market crashes are caused by an often-unexpected ‘crisis’. The pessimistic view will be that a crisis is always around the corner: commercial real estate, WW3, or new reserve currency. All are within the realm of possibility, but the reality is corrections happen far more often and true crises carry implications for the markets that couldn’t have been well known prior to them happening.

The past 100 years offers some helpful context. On average:

- a 5%+ sell-off is a three times a year occurrence,

- those greater than 10% usually happen once per year,

- a 15%+ downturn happens every couple of years, and

- a 20% or greater decline lands on our doorstep every 3-4 years.

Up and down in the markets will always be a reality for investors and will undoubtedly continue into 2025 and beyond. What matters most during these periods is how we respond to them. Controlling our emotions and proactively managing an investment portfolio means keeping your goals at the forefront, not letting ourselves get swept up in the good times, and not letting ourselves miss out on opportunities during periods of stress.