Market Overview

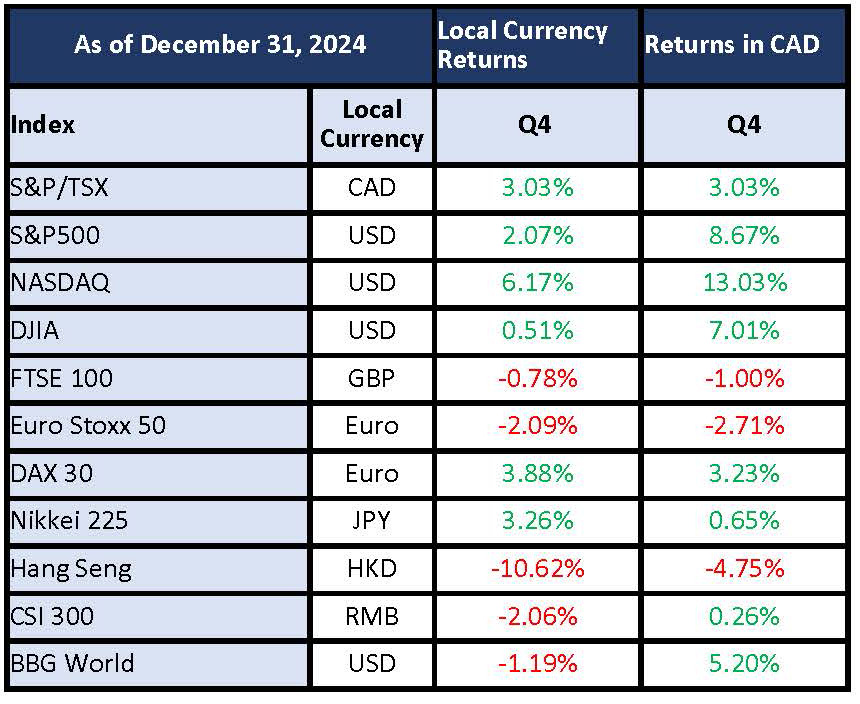

2024 was a very good year for investors with the strong performance in stocks being complemented by modest growth in bonds and alternatives. The biggest drivers of these returns were better than expected economic growth and continued progress on inflation. The U.S. economy led this improvement, but most regions enjoyed better growth than anticipated.

Despite the gains, December served as a reminder there were still meaningful periods of negativity. Geopolitical tensions weighed on Europe and a, now forgotten, blip in August led to significant declines in stock markets. December’s negativity saw stock markets give back some of their post-election gains from November as investors evaluated the possible impact of the new U.S. administration’s policies on inflation and global growth, possibly throwing cold water on additional declines to interest rates.

In this review we will take the opportunity to share our thoughts on the year and what to watch in 2025. Key themes discussed include:

- The U.S. S&P 500 achieved back-to-back years of over 20% annual gains – the best two-year stretch since 1997/98. The largest companies continue to drive these gains, but 2024 saw greater participation among other stocks and sectors.

- Investors cheered as the concern of a contested U.S. election dissipated. December saw renewed uncertainty for global growth and a hesitation to apply the markets’ 2016 rally to President Trump in 2024.

- U.S. markets are expensive and can only be supported by continued growth in company earnings.

- Global growth exceeded expectations and remains strong into 2025. This good news has brought about questions for central banks as they assess what to do next with interest rates.

- Broad commodities posted a positive return this year with gold posting the strongest return.

- The Canadian dollar was meaningfully weaker in 2024 relative to the U.S. dollar.

- This weakness was a further benefit to Canadian investors holding U.S. stocks, adding almost 8% to total returns.

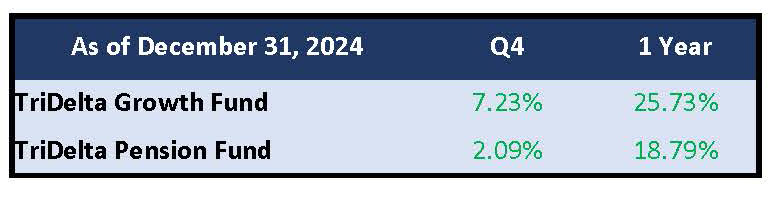

The TriDelta equity strategies benefited from being highly active throughout the year, demonstrating strong returns with much less volatility than broader markets.

In this quarterly review we will be discussing several key developments, what they mean for investment decisions moving forward, and what actions we are taking to benefit client portfolios.

What to Expect in 2025

Several unknowns hang over investors into 2025, but most still expect a reasonably good year, albeit with more volatility.

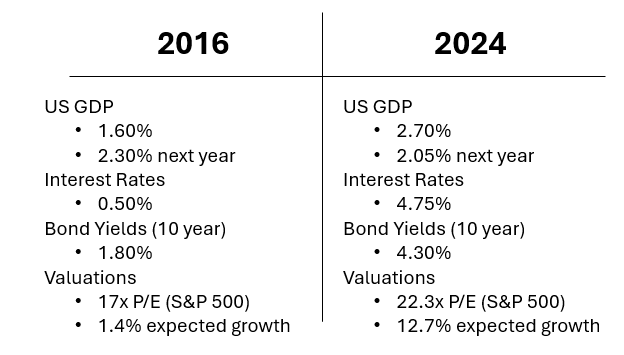

Starting Lines Have Changed – What Investors Should Expect From Trump 2.0

Perhaps the biggest question for investors today is what they can expect from a second Trump presidency. Even prior to inauguration, the impact on markets and global relations has felt immediate and dramatic. While there will continue to be periods of uncertainty regardless of election outcomes there are several points which can be made today.

- Politics is not policy, and near-term volatility should be viewed opportunistically rather than as a structural risk to the market.

- Trump’s cornerstone policies on tariffs and immigration are likely to be inflationary. Coupled with an already strong economy and low unemployment, means a more challenging path for the U.S. to continue bringing down interest rates.

- The starting line has changed. 2016 saw strong and growing U.S. GDP, low interest rates and low inflation. Today, interest rates are higher, inflation is a greater consideration, and U.S. stocks are meaningfully more expensive.

- This sets a much higher bar for continued returns like we have seen in the previous two years.

- Prioritizing domestic U.S. businesses at the expense of global trade will add to the volatility throughout the year, but not all businesses will experience this the same.

- Larger companies with profits outside of the U.S. may be more exposed to the impact of tariffs. The elevated concentration of U.S. markets and dominance of these larger companies may mean periods of significant weakness for the overall indices but also opportunities for smaller and middle market stocks.

- Risks to Canada should not be ignored. The Bank of Canada estimates that a 25% tariff would reduce GDP by 6%, exceeding the impact of any previous recession – excluding COVID. The U.S. would also face challenges related to reduced economic growth and rising inflation in this scenario.

- Reality check: Our ties to the U.S. are ingrained in the supply chains of many businesses on both sides of the border and the cheap Canadian dollar should provide an incentive for U.S. imports. The prospect of a more business friendly Canadian government should also support Canadian trade and growth.

The incoming U.S. administration will surely receive a lot of attention, but investors should look more broadly at the year ahead.

- We expect both economic activity and earnings growth to be more global than just a U.S. story. This should help broaden market leadership and benefit diversified portfolios.

- A change in market leadership may cause investors short-term pain. Global markets have relied on the returns of the largest technology companies and have become heavily concentrated in these stocks as a result.

- New companies or sectors driving returns may mean negative or flatter returns from the prior winners.

- Expensive U.S. valuations can only be supported by continued growth in company earnings.

- Less regulation, lower taxes, and government support for Artificial Intelligence can help but, the bar is much higher moving forward.

- Expectations for interest rates are changing quickly. Investors generally expect the Bank of Canada to reduce interest rates twice in the first half the year before pausing.

- The U.S. is seeing a very different backdrop with an economy stronger than many could have anticipated. Questions remain when, or if, rates will come down, but investors are currently expecting one or two cuts in the latter half of the year.

- The relationship between interest rates and government deficits suggests a more volatile path for bond markets.

Ultimately, investors should expect more volatility in 2025 and put an emphasis on having a diversified investment portfolio to help weather periods of heightened market stress. The success of the past two years has been one of the strongest for stocks since 1928. This does not by itself indicate we are in for a period of negative returns, but we caution against applying recent returns to meaning anything less will mean a disappointing year. Generally, we still expect a good year ahead but believe returns will be more challenging and put an emphasis on being more active.

What we are doing and why

Stocks

The fourth quarter saw investors again turn their attention to inflation and the trajectory of interest rates which stalled much of the post-U.S. election rally. While we see challenges ahead for stocks, we don’t think the worst-case scenario should be investors base case for 2025 and still view the glass half full given strong economic data, low unemployment, and improving outlooks for global growth.

- Expensive U.S. valuations is not the norm globally. Within a diversified portfolio the case should be made for more non-U.S. stocks.

- Canada trades at more reasonable levels and is expected to see corporate earnings move from very low growth to almost 10%. Japan and Europe too, have seen improving outlooks and should play some catch up in 2025.

- In Canada, technology, financials, and energy stocks led the way but we have reduced our exposure to Canadian banks. Valuations are near historic highs and any negatives to the Canadian economy could mean these stocks struggle over the next year.

- Presently, we are finding more opportunities in select individual stocks rather than overall sectors, and towards the end of the year took the opportunity to increase the defensiveness of our portfolios.

- Despite being expensive, there are still positives for the U.S. Many of the pro-business policies expected from the incoming government can propel stock prices higher.

We generally view 2025 as more volatile and have been adapting our portfolios to be more defensive so that we may capitalize on temporary shifts in market attitudes. The fact is, if earnings growth falls short, markets (or sectors) trading at a low valuation should be much more insulated than those trading at a high valuation. We believe this should put a premium on being more active throughout the year and support the case to be more diversified than broader indices. Our two strategies are very different than their benchmarks and achieved strong returns in 2024 without being exposed to the most expensive areas of stock markets today.

For an overview of how the funds stand today and our top holdings please visit our website for more information.

Learn more about our strategies:

TriDelta Pension Equity Fund

TriDelta Growth Equity Fund

Bonds

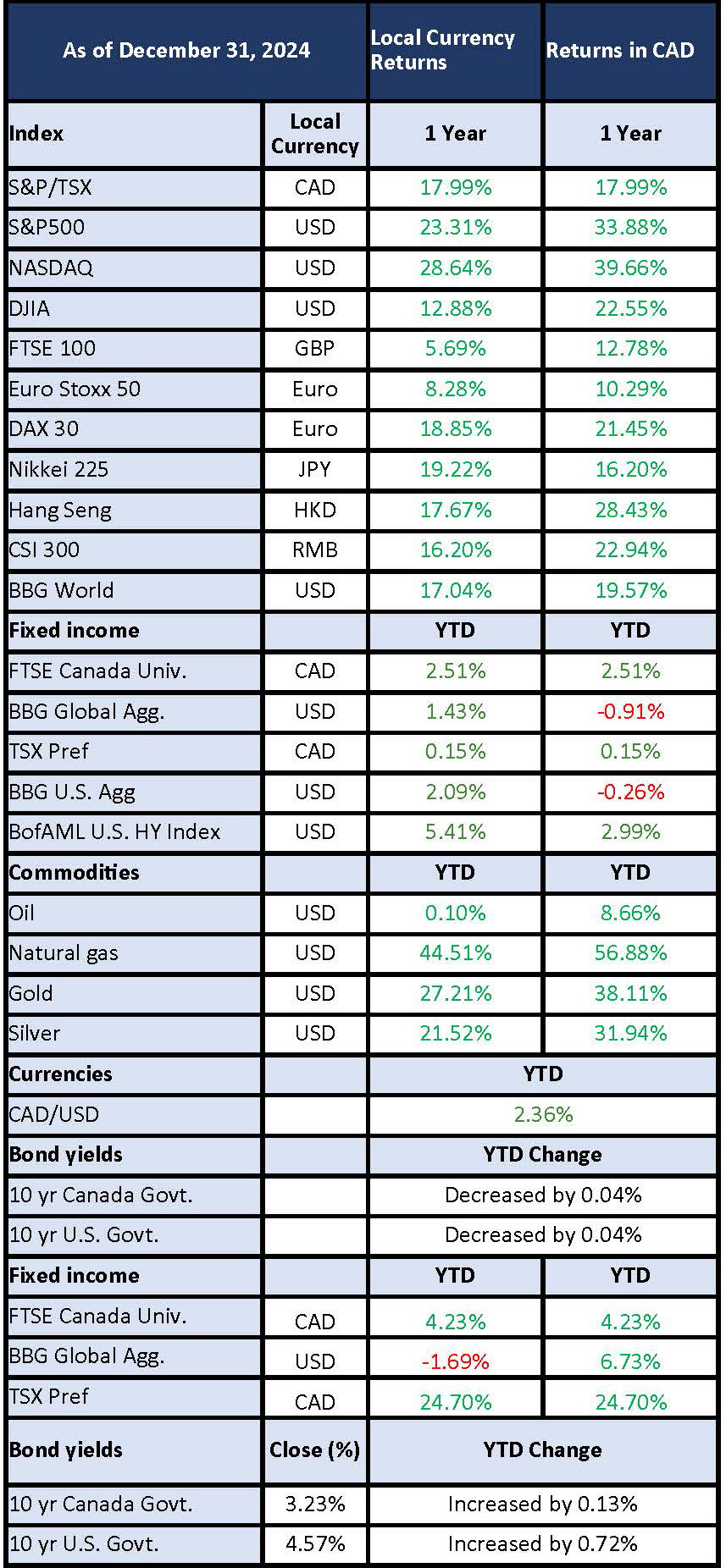

Investment grade Canadian bonds finished the year up 4.23% while global bonds were moderately negative. Volatility in bonds picked up to the end of 2024 as investors evaluated where interest rates head from here.

- Canada was among the most aggressive to lower interest rates in 2024 while the U.S. lowered rates three times; much less than the six cuts’ investors were predicting.

- The direction of interest rates will remain a key concern for investors and carry implications for bond and stock markets globally.

- Investors are not being adequately compensated for the risks in corporate bonds, both investment grade and high yield. This places an emphasis on being selective towards high quality investment grade bonds.

- With most of the declines in interest rates behind us, the primary component of bond returns in the year ahead is likely to be from the income yields rather than price movement.

- Rising income yields from bonds will lead to more competition for stocks. We last saw this in 2022 when the U.S. 10-year bond yield reached 5% and stocks fell 10%.

- The increased income available from bonds forces investors to reassess the expected return from stocks and other investment types. While a source of volatility, the declines in 2022 proved an opportunity for dividend investors.

There are several reasons to be very active in fixed income today, regardless of whether your goal is to enhance portfolio diversification or achieve a positive return. We recommend looking outside of government bonds. Select corporate bonds, structured notes, and LRCNs offer meaningful advantages to building a diversified portfolio without jeopardizing overall returns.

Preferred Shares

Canadian preferred shares finished off a banner year up almost 25%. This asset class rode a wave of redemptions in the final months of the year to outperform both Canadian stocks and bonds. We have spoken much of this redemption trend and believe it is here to stay. There is a significant premium to being able to determine which shares will be redeemed and is an important focus for our investment team.

Commodities

Most commodities performed well throughout the year. Notably….

- Gold fell after the results of the U.S. election, but the decline did not last long, and prices recovered through the remainder of the year.

- Many believed the election would be contested which led to investors parking money in gold to ride out the uncertainty. After the election results became clear, much of that fast money left. The continued gains in gold reflect central banks increasing their holdings of gold and renewed concerns for inflation into 2025 and beyond.

- Energy was volatile most of the year, but most expect modest growth in 2025.

- Several negatives for oil were priced into energy stocks to finish the year. Chinese demand was weaker in 2024, and global excess supply has dragged on prices. The possibility of increased production from the U.S. also adds to the uncertainty for oil.

- Natural gas too had its own difficulty. The supply is well above its five-year average and warm winters have added to the oversupply. Europe is also over supplied given the 2022/23 scramble to add storage due to Russian sanctions.

- Uranium has garnered more attention as a reliable and cleaner source of energy for meeting global demands for energy.

Commodities have served as an important diversifier and source of return for investment portfolios, and we expect this to continue.

Alternatives

With increasingly expensive equity markets and a rising correlation with bonds, alternative investments – those not publicly traded – can greatly enhance an investment portfolios diversification.

Key updates for our portfolios include:

- Private debt in Canada and the U.S. have performed very differently but are benefiting from an expanded pool of opportunities for lending.

- The U.S. market has further benefited from its relative size and persistently strong growth amongst global peers. Canadian private companies are highly reliant on this private lending, however, suffer from a smaller accessible market and a more uncertain environment for consumer spending. This has led to more mixed returns from Canadian private lenders.

- Generally, liquidity has been strained among private lenders as investors chased income from higher yielding bonds and gains in stocks.

- Private real estate should see significant growth as demand continues to outpace supply due to ongoing population growth, slower housing developments and affordability challenges.

- In Canada, population growth remains higher than all G7 peers while also ranking last in available housing. Recent and proposed immigration changes are unlikely to change that.

- Reduced immigration targets are unlikely to produce negative population growth.

- Even with reduced population growth, construction capacity constraints will still prevent Canada from making up for past housing shortfalls.

It is becoming increasingly difficult to diversify portfolios using traditional, public asset classes. Alternative investments offer a means of reducing volatility, enhancing cash flow, and co-investing with large institutional investors.

Early 2025 Reminders

Maximizing the value of your registered accounts through annual contributions is an important component to building wealth. 2025 brings new contribution availability for Canadians and making your contribution(s) early can be an important step to tax savings and tax-sheltered investment growth.

- You have until Monday March 3rd, 2025 to contribute to your RRSP for a 2024 tax deduction.

- Your contribution limit is the lesser of 18% of your earned income or $31,560.

- Your TFSA limit has increased another $7,000.

- The lifetime contribution limit is now $102,000 for those aged 18 or older in 2009.

- Those with an FHSA may contribute an additional $8,000 for a 2025 tax deduction and investment growth for owning their first home.

- For those with an RESP or RDSP and still in the contribution stage, you can now make a 2025 contribution to receive the government grant earlier in the year.

Looking Ahead

It is nothing new that investors are uncertain over the path ahead. Some may use this as a justification to avoid investing all together and we understand the anxiety. Most of us would probably describe ourselves as trying to be healthier, but avoiding junk food doesn’t mean avoiding all food.

There remain attractive options for investing, but sometimes that means looking differently than everyone else. We see value in this approach and know it will serve our clients well into 2025 and beyond.