The Ebola Virus, Greek Crisis, Debt Ceiling, Refugee Crisis, Global Warming, Brexit, Trump, North Korea…there is always something scary for the media to report and make us nervous. Usually, these headlines frighten investment markets. For some reason, 2017 didn’t see this. In many major markets, there was not one decline of 5% during the year, and outside of Canada’s 6% stock market growth (which was among the weakest in the World), most stock markets saw returns well in excess of 12%.

The Ebola Virus, Greek Crisis, Debt Ceiling, Refugee Crisis, Global Warming, Brexit, Trump, North Korea…there is always something scary for the media to report and make us nervous. Usually, these headlines frighten investment markets. For some reason, 2017 didn’t see this. In many major markets, there was not one decline of 5% during the year, and outside of Canada’s 6% stock market growth (which was among the weakest in the World), most stock markets saw returns well in excess of 12%.

Like a sports team that makes it through a season with no major injuries, 2017 was one of those years. To count on that happening again is to bet against history. The question isn’t so much what will cause greater volatility, as much as when. The next question is whether we should really fear volatility, especially if markets end up alright in the end?

While those holding individual stocks and bonds would see bigger differences in portfolio returns, our TriDelta funds provide a good overall picture of our investment performance. These returns are before fees:

| TriDelta Growth Equity Fund | 13.3% |

| TriDelta Pension Equity Fund | 12.5% |

| TriDelta High Income Balanced Fund | 10.0% (the four year return on the fund is 9.2%) |

| TriDelta Fixed Income Fund | 6.5% (this was among the top 1% of Canadian Bond Funds) |

Our lower exposure to Canada helped the funds meaningfully outperform the TSX return of 6.0%.

The 6% yield on the High Income Balanced Fund, along with some stock exposure provided solid returns.

The outperformance on the Fixed Income Fund was largely due to strong active management. Our portfolio manager anticipated when to shift from shorter dated to longer dated bonds and from corporate to government exposure. Returns were also helped by some small Preferred Share exposure and opportunistic currency decisions.

Without further ado…

Valuations are high, particularly in the U.S., which often indicates low or negative equity market returns, but we have searched for signs and signals of a market pullback, and we are not seeing it in the near term.

This doesn’t mean that it won’t happen during the course of the year, it most surely will. Yet, for the early part of 2018, we remain bullish on stocks.

We believe the following:

*Stocks will remain positive but returns will be better outside of North America. Geographically, the U.S. market appears to be further along the cycle than markets in Europe and Japan and much further along than Emerging Markets. This is based on higher valuations, Central Banks’ raising interest rates, and Consumer Confidence Indices.

As a result, we see Non-North American markets benefiting more in 2018, due to the same low interest rates and quantitative easing that helped the U.S. in 2017.

*Interest rates will not rise as much as expected. While it looks very likely that Canada will raise interest rates this month, and the U.S. will likely raise rates in March, both central banks will be cautious about further rate hikes. Of interest, if the market is expecting 3 rate hikes, and there are only 1 or 2, the bond market is likely to perform better than expected. In Europe and Emerging Markets, some decrease in quantitative easing is expected, but little in the way of actual rate increases will be seen in 2018.

*Marijuana stocks and cryptocurrencies will see major declines in 2018 (from January 9th). This is based on the simple fact that Marijuana stocks are at valuations today that are priced beyond perfection for most companies and cryptocurrencies have yet to see the wrath of the IRS or other major Government agencies. In addition, they use an enormous amount of energy and often originate from poorly regulated countries. Government actions will be coming very soon under the guise of regulatory stability and countering tax evasion, and we expect most cryptocurrencies to see a bubble burst during the year.

*The Canadian Dollar will continue to surprise, but should decrease overall. The difficulty in predicting currency is that there are many important moving parts globally and locally. In the case of Canada and the U.S., NAFTA, the price of Oil, interest rates, and US$ repatriation will all be key drivers of currency changes and will result in several shifts during the year. We believe that interest rates will start to play a lesser role in the currency than it has in the past few years, as the other factors mentioned increase in relative importance.

We expect that the lowering of U.S. Corporate tax rates will drive some Corporate M&A activity. This may result in more Head Offices moving back to the U.S. and shifting dollars and taxes along with it. This will be an important strength contributor for the U.S. dollar in 2018.

*Toronto and Vancouver Real Estate Markets will be more stable….but still grow. Despite changes to mortgage rules, China’s flow of foreign funds, and Canadians comfort with high debt, the main thing that will truly pull back residential house prices is meaningfully higher interest rates. Increases in rates and tighter mortgage rules will help to restrain rapid growth, but until we start to see 5%+ five year fixed mortgage rates (you can still find low 3% rates), we won’t see a significant pullback. We may be a couple of years away (or longer) from seeing those rates.

*Alternative Income Investments should boost returns in 2018. We continue to look at and occasionally add investment options that we believe will provide returns of 6% to 10% most years, have a very low volatility, and little connection to stock market returns. These investments are similar to those that are a key part of portfolios that make up the Canada Pension Plan, Ontario Teachers’ Pension Plan and the Harvard Endowment Plan.

Compared to a world of only stocks and bonds, these alternative investments can help lower overall portfolio risk, add to returns and generate income. The downside is that these are Private Investments, not fully available to all investors, and liquidity is lower than for public investments (stocks and bonds).

One TriDelta advantage is that due to our strength in this area we have been able to negotiate institutional rates, resulting in lower costs for our clients from certain providers.

*Preferred Shares will see more normalized returns but remain an important part of the mix. After a year which saw Preferred Shares gain 13%, we see more typical 4% to 7% returns out of this asset class in 2018. The advantages of Preferred Shares are the tax benefit of Canadian Dividends (many retirees and middle income Canadians pay a tax rate of 10% or less), as well as the ability to benefit from both rising and falling interest rates – depending on whether you own fixed rate or rate reset preferred shares. This flexibility provides an important distinction from bonds.

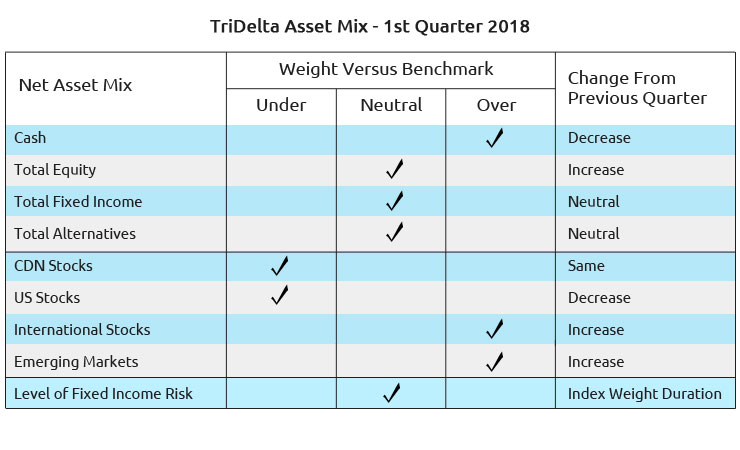

As a result of these beliefs, we enter 2018 with the following tactical asset allocation.

Based on these factors, we are increasing our exposure outside North America – both to Developed and Emerging Markets. We are decreasing our exposure to the U.S. market, and maintaining an underweight to Canadian markets.

Early 2018 will likely see the continuation of the strong stock markets that we saw in 2017. At some point, however, we expect to see the U.S. market buckle a little. The catalyst could come from increased pressure of a mid-term U.S. election that may shift control of the House and Senate from Republican to Democrat hands. Traditionally, a Republican President and Democrat House and Senate have not been ideal for stock markets.

When technical market indicators suggest reducing risk, we will ease back on stock weightings. By maintaining strong portfolio diversification from Alternative Investments, Preferred Shares and active Bond management, we will aim to reduce volatility for clients. Our best guess is that most clients will see positive, but lower returns in 2018 than 2017.

Lower volatility, a long term plan, tax efficiency and financial peace of mind are the hallmarks of TriDelta.

We will do our best to continue to deliver that to our clients in 2018 and for the long term.

All the best to our readers for a healthy and prosperous year ahead.

TriDelta Investment Management Committee

VP, Equities |

VP, Fixed Income |

President and CEO |

Exec VP and Portfolio Manager |

VP, Portfolio Manager and |

|